Products Listru

Investment quota for RMB program to strengthen Germany as yuan center ru

|

|

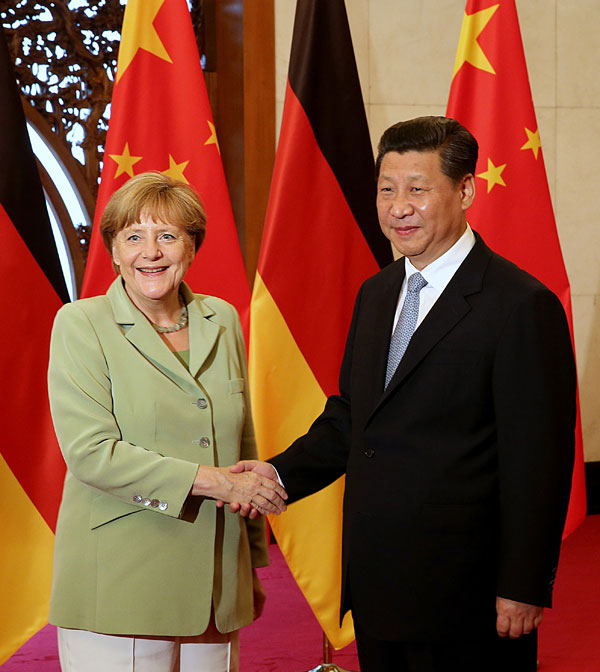

President Xi Jinping meets German Chancellor Angela Merkel at the Diaoyutai State Guesthouse in Beijing on Monday. |

China and Germany will strengthen exchanges in the financial sector and upgrade longstanding cooperation in manufacturing with a slew of deals signed on Monday.

Beijing will grant Berlin an 80 billion yuan ($12.9 billion) quota under the Renminbi Qualified Foreign Institutional Investors plan toru accelerate the internationalization of the Chinese currency, reinforcing Frankfurt's status as a yuan clearing center in Europe, in addition to London and Paris.

A high-level financial dialogue will also be set up to boost financial cooperation, Premier Li Keqiang said at a news conference with visiting German Chancellor Angela Merkel.

President Xi Jinping told Merkel during their meeting, "The series of agreements you have signed during your visit to China will bring new impetus to bilateral ties."

Xi suggests the two countries take bigger steps in their cooperation, with manufacturing industry as the core.

Merkel said Germany would improve its investment environment and attract more Chinese investors.

She is accompanied by a high-profile business delegation including executives from Siemens, Volkswagen, Airbus, Luft-hansa and Deutsche Bank.

Apart from the financial deal, the countries also signed deals on ru automobiles, aviation and telecommunications.

China approved London joining the RQFII plan in October, granting investors the right to use the yuan to buy up to 80 billion yuan worth of mainland stocks, bonds and money market instruments.

It later granted Paris the same quota in March.

Luxembourg is also lobbying Beijing for the same treatment after it signed an agreement with China's central bank for yuan clearing arrangements on June 28.

Li Jianjun, a financial analyst at Bank of China's International Finance Research Institute, said the competition for offshore yuan centers among major European cities is a healthy feature of cooperation.

"The renminbi is still at the initial stage of internationalization. We are expanding the offshore yuan pie and setting up a global network with overseas financial markets. Allowing qualified foreign institutional investors to use the yuan will benefit China and other countries," Liru said.

Chinese leaders are likely to take Frankfurt as a core center for renminbi clearing services in continental Europe, while establishing secondary yuan clearing sites in Paris and Luxembourg, Li said.

"We cannot cover a wide range and a large amount of renminbi-related businesses with only one center," Li said. "With Frankfurt as a leading offshore yuan-trading city, we will create a nice layout for renminbi internationalization in Europe."

In the first five months of 2014, Germany's direct investment in China reached $810 million, or 30 percent of the $2.69 billion investment in China by all members of the EU, according to the Ministry of Commerce.

In 2013, two-way trade between the countries reached $161 billion, taking up almost one-third of total China-EU trade.

China is Germany's largest trading partner in the Asia-Pacific region.

Merkel's visit, her seventh trip to China, came only four months afterru the last meeting between leaders of the two nations. President Xi Jinping visited Germany in March.

Before flying to Beijing, Merkel stopped at Chengdu, capital of Sichuan province.

Merkel said she felt the dynamics and development of southwestern China in Chengdu, where urbanization is urgently needed to catch up with coastal cities.

"China's vigor stays not only on the coastline but also in the central and west area," she said.

Sebastian Heilmann, president of the Mercator Institute for China Studies, said in a recent interview with Deutsche Welle: "Germany provides China with products it needs for industrialization, for example ,machines, specialty chemicals and electronic goods. On the other hand, Chinese consumer goods with very reasonable prices are in high demand in Germany."

Ren Baiming, a researcher at the Chinese Academy of International Trade and Economic Cooperation at the Ministry of Commerce, saidru Germany, as well as the European Union at large, need a driving force from the outside for growth, and the fast-growing Chinese market meets that need.

ru